Building data driven Proprietary Trading excellence.

We deploy our own capital to blend algorithms, research, and disciplined strategies for effective market navigation.

Options and Risk Management Strategies

Methods to leverage volatility while maintaining structured risk controls. These techniques allow for adaptive positioning in varying market environments.

Option Buying

Option Buying

Option Selling

Option Selling

Hedging

Hedging

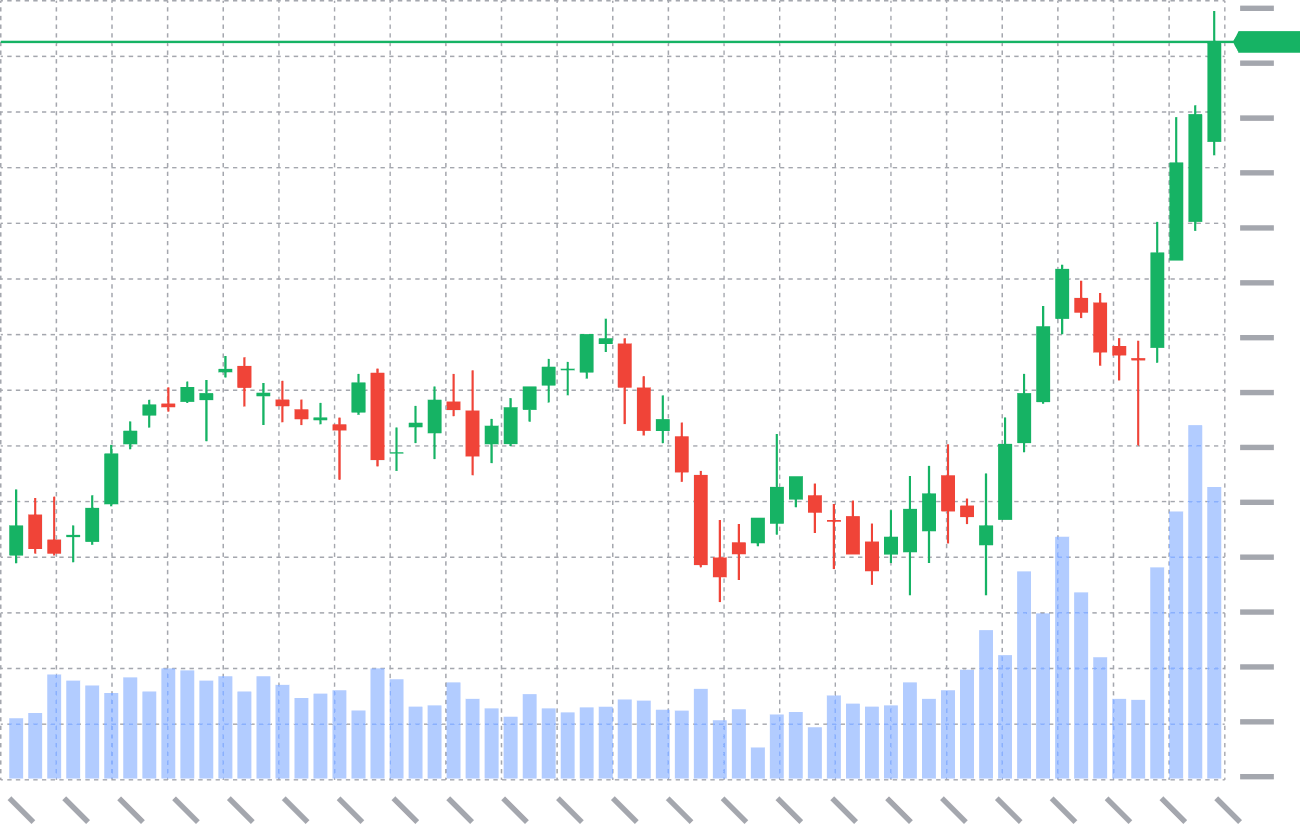

Tactical and Active Trading Approaches

Trades tailored to different timeframes in stocks, currencies, and commodities. We focus on accurate timing and quick adjustments to market changes.

Swing Trading

Capturing short-term price swings over days to weeks.

Equity Trading

Buying and selling stocks for intraday or positional gains.

Forex Trading

Exchange-traded INR pairs like USD/INR via futures and options.

Commodity Trading

Dealing in goods like gold and oil futures.

Scalping

Making quick trades for small, frequent profits.

Balanced Short and Long-Term Investments

Selections for capital growth across varying horizons. These investments emphasize fundamental analysis and strategic timing for value realization.

Long-Term Investment

Concentrated holdings in quality firms.

Short-Term Investment

Holding assets briefly to capture market opportunities.

Value Investing

Buy undervalued assets for multi-year growth.

Dividend Focus

Select stocks with consistent payouts and reinvestment.

In markets defined by uncertainty, true edge comes from disciplined systems, not speculation. At STAKEDEC, we build strategies that prioritize data, mitigate risks, and pursue sustainable growth, turning volatility into opportunity for the long haul.

Building Data-Driven Proprietary Trading Excellence

© 2025 StakeDec Private Limited. All rights reserved.